70% of the consumption is made through the traditional channel and the wineries are a very strong element in the purchase of the Peruvian.

The traditional channel in Peru is one that allows you to sell a product to the consumer through markets, warehouses and kiosks.

Among the main characteristics of the traditional channel is that the number of points of sale does not decrease despite the growth of the modern channel. In addition, it is the main means for sales of the categories of first necessity.

The economic situation causes the shopper to take refuge in the traditional channel and make daily purchases, hitting the self-service channel that is designed to generate a greater purchase routine.

“The average family makes small or medium purchases in the traditional channel. More than 80% of the shopper’s spending is by basic categories, “said Cecilia Ballarin, Client Development Manager of Kantar Worldpanel.

In the interior of Peru, the wineries and markets continue at the top, reflecting more than 90% of sales; and in the case of the capital, 70%.

The traditional channel responds especially to the need of a population whose income is daily or weekly, a population that represents more than 50% of the EAPO that forces them to make the purchase on a daily basis, with a small volume and in a nearby place.

It should be noted that the markets and warehouses are a distribution channel more than the companies choose to take their products to the consumer in the most complete, efficient and economic way possible.

CHARACTERISTICS OF THE TRADITIONAL CHANNEL

– Price is a key element

– There is little brand fidelity

– Daily or weekly income with little access to credit

– Daily purchase frequency

– Does not have own transport

– The high informality of the traditional channel allows to have low operating costs and therefore good prices

CHALLENGES AND STRENGTHS OF PERUVIAN BODEGAS

The wineries are present in our day to day.

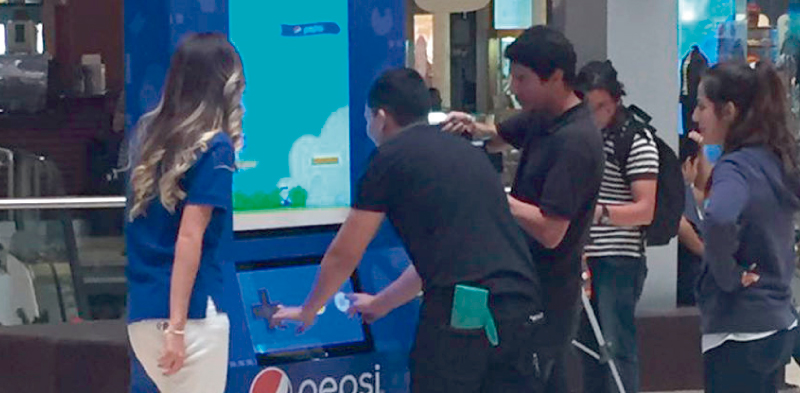

These stores compete with the modern commerce that little by little has managed to advance in its penetration in the last 20 years.

“70% of the consumption is done through the traditional channel and the wineries are a very strong element in the purchase of the Peruvian,” said Yadira Kawasaki, business development manager of Fundes Peru.

To date, there are approximately 400,000 wineries throughout Peru, of which about 200,000 are concentrated in Lima on average.

Today, the challenge of the wineries is to renew, diversify and improve the services they offer their customers against the competition.

“The winemakers must diversify the forms of payment and that is not only cash because they are competing with the convenience and discount stores that have implemented POS. A differentiated offer of services and products will allow entrepreneurs to begin to feel the impact on their businesses, “Kawasaki told Peru Retail.

He also said that they want winemakers to realize the important role they have in people’s daily lives.

However, the wineries have great challenges to be able to compete with the convenience and discount businesses.

“Today its new competition is convenience stores and discount, because there is a vacuum that the winemakers have not filled, composed of modernity and technology,” said Víctor Guaylupo Marroquín, director of the School of Business Development of Arca Continental Lindley.

SALE OF BEVERAGES

For the winemaker, the sale of beverages will always be important, approximately 20% of the total. That is, 1 out of every 4 that goes in buys a big or small drink.

Among the buyers, the drinks represent 44% of their spending per purchase trip (average of 6 soles per soft drink).

Source: PerúRetail

Español

Español